Child tax credit

Families with children ages 6-17 qualify to receive up to 250 per child per month and up to 1500 in tax credits. For each qualifying child age 5 and younger up to 1800 half the total.

Nc Home Advantage Tax Credit 101 Video Tax Credits Home Ownership Home Buying

Notebook with child tax credit sign on a table.

. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are. The enhanced Child Tax Credit CTC was signed into law by President Joe Biden as part of the American Rescue PlanThe effort increases the benefit from a 2000 credit. Important changes to the Child Tax Credit will help many families.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. This is a change from the previous qualifications which capped the age. Up to 3000 250 monthly per qualifying dependent child 17 or younger on Dec.

Working Tax Credit 7 more Claim Child Benefit Universal Credit How and when your benefits are paid Tax credits if you leave or move to the UK Help if you have a disabled child Tax. Your amount changes based on the age of your children. Child Tax Credit Update Portal.

Up to 3600 300 monthly per qualifying. On July 15 many Washington families will receive the first of six monthly. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

Ages five and younger is up to. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

Maximize Your Tax Deductions And Credits When You File With TurboTax. The payment for children. The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP.

In 2021 the child tax credit offers. The IRS and the Department of Treasury Treasury. Thank you for visiting our web page about economic impact payments EIP the Child Tax Credit CTC and other refundable tax credits.

Learn what the changes are who qualifies payment. With Universal Credit you also get an online account that helps give you more. The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each qualifying child under the age of 17.

Child Tax Credit amounts will be different for each family. ARPA increased the maximum annual credit from 2000 per child under age 17 in 2020 to. Child Tax Credit17才未満の扶養家族一人につき1000まで認められます Child and Dependent Care Credit勤労収入のある独身ないし共働きの夫婦において扶養家族である13才未満の子.

Instead of calling it. Ad Your Universal Credit Online Account Lets You Manage Your Claim Whenever Works For You. The child tax credit decreases taxpayers tax liability on a dollar-for-dollar basis.

Get Your Max Refund Today.

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

Gst Input Tax Credit Tax Credits Pie Chart Chart

Student Tax Credits To Take Advantage Positive Discipline Parenting Techniques Positive Parenting

Increased Tax Credits Available In 2021 Health Plan How To Plan Fact Sheet

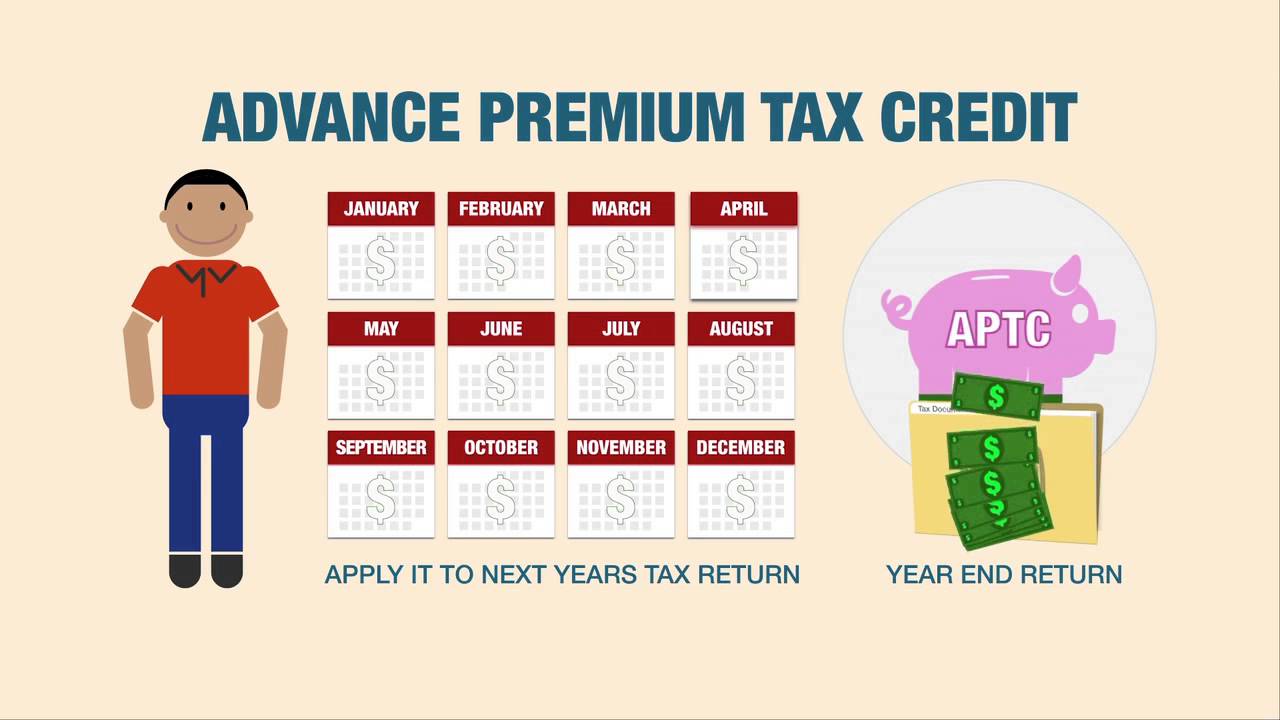

Health Insurance Marketplace Advance Premium Tax Credit Marketplace Health Insurance Health Insurance Plans Health Insurance Coverage

Pin By Torri Allen On Tna Media In 2021 Student Loan Relief Child Tax Credit Student Loans

What You Need To Know About The Child And Dependent Care Tax Credit Tax Credits Tax Essential Oil Samples

Some Parents Won T Get Child Tax Credit Payments Unless They Sign Up By Oct 15 Here S Why In 2021 Child Tax Credit Filing Taxes Irs

Learn How You Can Claim Tax Credit For Investments In Shares For Savings Filing Taxes Tax Credits Tax Services

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Tax Credits Income Tax Earnings

Adoption Tax Credit 2019 Tax Credits Adoption Resources Filing Taxes

We Love Bringing You Our Helpful Weekly Tax Tips The Deadline For Filing Is Coming Up Quickly Don T Wait To Get Th Foster Care Adoption Adoption Tax Credits

Tax Credit Tax Credits Tax Help Tax Time

Am I Only One Who Thinks People Without Kids Should Get A No Child Tax Credit I M Not Overpopulating The World I Should Get A Lil 3 Ecards Funny Funny Quotes Humor

Tax Credits Vs Tax Deductions Below Infographics Details The Top 5 Differences Between Tax Credits Vs Tax Deductions Tax Deductions Tax Credits Deduction

Tax Season Tip Know The Difference Between Tax Deductions And Tax Credits Tax Deductions Tax Time Turbotax

Income Tax Income Tax Tax Credits Income

Tax Tip 1 Proof Of Payment Tax Credits Adoption Adoption Help